[ad_1]

Within the first of a five-part sequence on find out how to construct a sustainable public worker retirement system, the Motive Basis’s Steven Gassenberger examines how altering employee habits ought to assist form reform.

Over the past decade, Public Staff’ Retirement System of Mississippi (PERS) knowledge has proven a major enhance within the price public workers are quitting, with most shifting to a different profession inside the first 5 years of taking their authorities job. Understanding and addressing the evolving wants of latest hires is essential for PERS, not just for its monetary sustainability but in addition for its potential to proceed to offer enough retirement advantages for its members.

An analysis of present PERS retention charges means that policymakers have a possibility to maneuver away from the one-size-fits-all retirement profit presently provided and that solely a fraction of workers will in the end obtain and towards offering retirement profit choices that may accommodate the wants of each profession and non-career workers.

Shifts in PERS Member Retention

PERS Retention Tracks with Different States

To correctly worth and fund a public pension profit like PERS, the assumptions actuaries use—comparable to the speed at which new hires will go away (or withdraw from) the system—should be correct or else unfunded liabilities accrue. The withdrawal charges assumption helps estimate the anticipated variety of separations from lively members on account of resignation or dismissal.

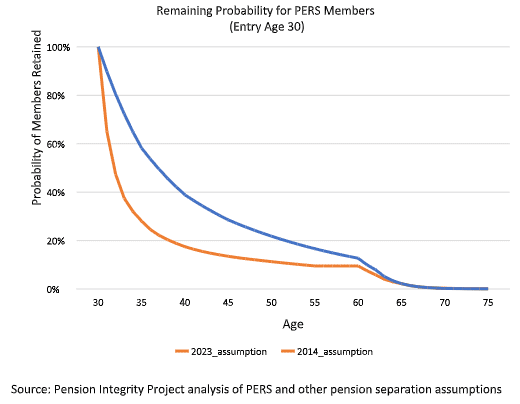

Over the past decade, PERS actuaries have responded to main nationwide shifts in retention charges by adjusting the system’s withdrawal assumptions upwards as a result of the precise variety of withdrawals has constantly exceeded expectations since 2014, significantly amongst youthful workers. In 2014, 22% of latest male hires and 25% of latest feminine hires have been anticipated to go away after the primary 12 months of employment. By 2023, these figures had surged to 42% and 45%, respectively.

Assumed Withdrawal Charges After 1 Yr of Service

Based mostly on the withdrawal charges utilized by PERS for 2014 and 2023, Pension Integrity Mission evaluation exhibits that 70% of latest members coming into at age 30 will go away inside 5 years of service, in comparison with 40% in 2014. Even members who be part of the system later of their careers are exiting sooner than earlier than, with solely a 50% likelihood of a member coming into at age 50 remaining after the primary 5 years of service.

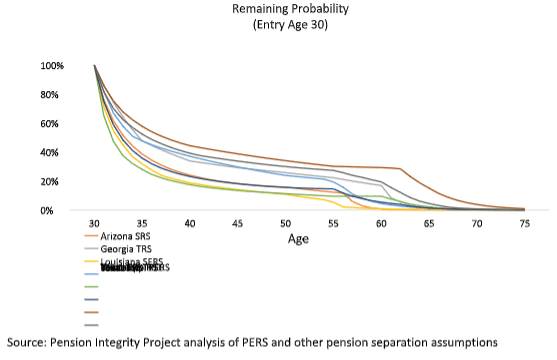

Increasing the evaluation to incorporate different giant plans protecting public workers, such because the Wisconsin Retirement System (Wisconsin RS), Louisiana State Staff’ Retirement System (Louisiana SERS), and Staff Retirement System of Texas (Texas ERS), reveals an identical development.

In Louisiana SERS, solely 31.8% of latest public workers are anticipated to stay after 5 years of service, in comparison with 35.8% in Texas ERS. Even a well-funded plan like Wisconsin RS sees practically half of latest members go away the system after the primary 5 years.

On common, the likelihood of staying past 5 years of service for a member becoming a member of at age 30 is properly beneath 50%. Sometimes, eligibility for retirement begins at age 55. Nevertheless, fewer than 30% of members stay by this time.

In comparison with different state-run pension techniques, the Mississippi Public Staff’ Retirement System (PERS) reveals a notably excessive price of early turnover amongst its members and imposes one of many longest vesting interval necessities amongst related pension techniques, set at eight years for brand spanking new members employed after July 1, 2007. Consequently, round 80% of latest members are anticipated to go away the plan earlier than reaching the vesting interval. When PERS members terminate their employment earlier than vesting, they’re eligible just for a refund of their very own contributions plus a credited curiosity of two%. They don’t obtain any employer contributions made on their behalf. Subsequently, solely about one-fifth of PERS members are estimated to in the end obtain pension advantages.

The general development—and the extra essential a part of the story for policymakers to contemplate—is that PERS’ present problem with serving new hires displays a nationwide sample of behavioral shifts amongst public staff. All these plans face practically the identical retention problem at the same time as they proceed providing these conventional pensions, elevating doubts concerning the effectiveness of pensions as a car for recruiting and retaining workers.

The truth is, the outcomes of those withdrawal patterns recommend that policymakers mustn’t function beneath the idea that pensions have a novel potential to draw new staff. Seeing that workforce habits has considerably shifted all around the nation, and the way pensions have had no perceivable affect on stemming that shift, lawmakers in Mississippi ought to reevaluate what they’re aiming to attain with PERS.

Moreover, they need to be involved with how poorly the present plan serves the overwhelming majority of employed folks. It’s clearly time to discover extra different choices for brand spanking new hires that can foster enough financial savings for retirement, even when their tenure with PERS is only some years.

[ad_2]

Source link