[ad_1]

India has overtaken China when it comes to financial progress, signaling a significant shift in international economics. This transition, anticipated by many analysts, is now being amplified by inventory markets, illustrating not solely an financial realignment but in addition far-reaching geopolitical penalties. Because the world’s two most populous nations, every with roughly 1.4 billion inhabitants, China and India aren’t simply Asia’s strongest economies but in addition political rivals with contrasting authorities fashions. China, the only communist superpower, and India, the world’s largest democracy, signify two opposing ideologies and governance fashions. The result of their financial rivalry is ready to profoundly affect international geopolitics.

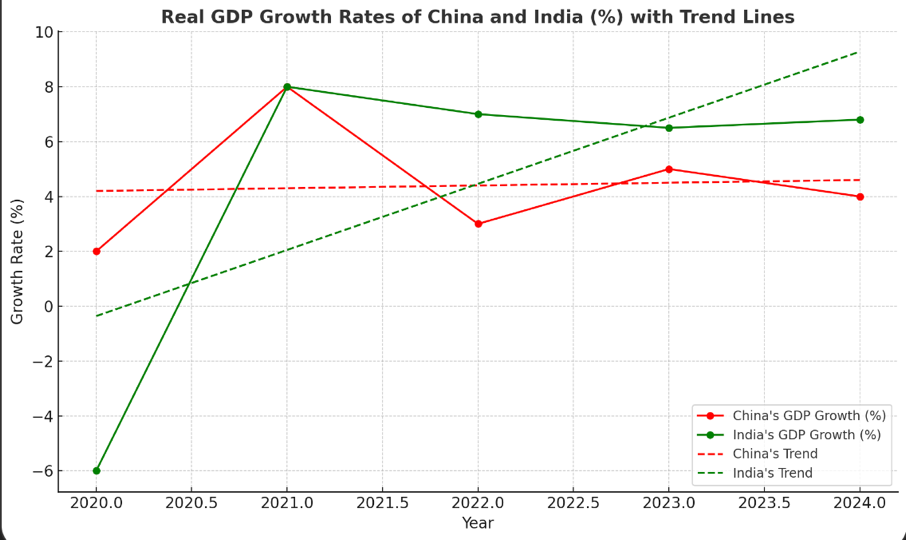

1. Actual GDP Progress Charges: China vs. India

The primary graph depicts the actual GDP progress charges of China and India from 2020 to 2024, exhibiting a marked divergence between these two financial giants.

China’s Financial Path (Pink Line):China skilled a powerful post-pandemic rebound in 2021, with GDP progress peaking at round 8%. Nevertheless, in subsequent years, progress slowed to about 4% by 2023 and 2024. The pink dashed pattern line reveals a transparent deceleration, reflecting deeper structural points akin to an getting older inhabitants, excessive debt ranges, and the affect of regulatory tightening.India’s Financial Path (Inexperienced Line):India, after a pointy contraction in 2020 as a result of pandemic, rebounded robustly in 2021 with progress charges exceeding 8%. Though progress tapered off barely in 2022, India’s economic system stabilized round 6% by 2024. The inexperienced dashed pattern line signifies an upward trajectory, highlighting India’s long-term financial momentum fueled by its youthful demographic, technological developments, and rising home consumption.

Key Observations:

Rivalry for Progress Management: China and India have lengthy been on the forefront of worldwide financial progress, however India has now overtaken China when it comes to progress price. This financial rivalry displays their broader geopolitical contest, with every nation vying for affect in Asia and past.Contrasting Progress Developments: Whereas China’s progress is slowing, India’s economic system is on a gradual upward pattern, showcasing its resilience and rising prominence on the world stage.

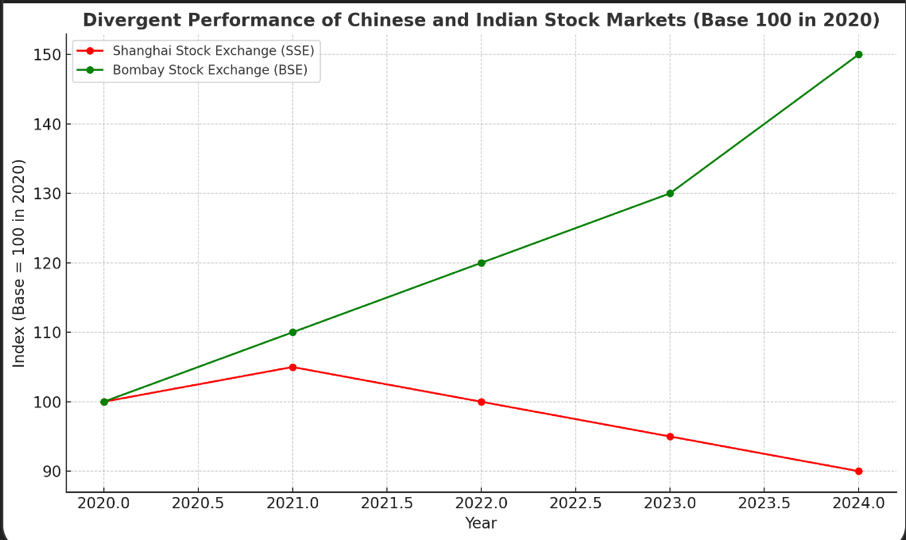

2. Inventory Market Efficiency: Shanghai Inventory Trade vs. Bombay Inventory Trade

The second graph compares the efficiency of the Shanghai Inventory Trade (SSE) and the Bombay Inventory Trade (BSE) from 2020 to 2024. The divergence of their inventory market trajectories mirrors their financial progress patterns.

Shanghai Inventory Trade (SSE) Efficiency (Pink Line):The SSE noticed average progress in 2021, reflecting China’s temporary financial restoration after the pandemic. Nevertheless, from 2022 onward, the SSE’s efficiency declined steadily, dipping beneath its 2020 baseline by 2024. This displays a mixture of financial deceleration, regulatory crackdowns, and investor wariness about China’s rising inner challenges, akin to its actual property disaster and rising debt.Bombay Inventory Trade (BSE) Efficiency (Inexperienced Line):In distinction, the BSE confirmed constant progress, rising sharply after 2021 and reaching an index worth near 150 by 2024. India’s inventory market efficiency highlights international investor confidence within the nation’s financial prospects, pushed by its reform agenda, demographic dividend, and burgeoning digital economic system.

Key Observations:

Market Sentiment Shifts: The rising hole between the SSE and BSE displays a big shift in international capital flows. Traders, as soon as closely targeted on China, are actually turning to India as a brand new progress hub, attracted by its democratic stability, reform-driven progress, and a extra predictable regulatory setting.Inventory Markets as a Reflection of Governance Fashions: The divergence in inventory market efficiency additionally mirrors the basic variations in governance between China and India. China’s centralized, state-controlled system has launched unpredictability for international traders, notably because of regulatory crackdowns. India’s democratic system, whereas not with out challenges, affords extra clear and market-friendly insurance policies, enhancing investor confidence.

3. Geopolitical Implications: A Contest Between Two Ideologies

The financial and inventory market divergence between China and India isn’t just an financial story—it represents a broader ideological contest between two very totally different fashions of governance. China, the one communist superpower, and India, the world’s largest democracy, are engaged in a strategic and financial rivalry that can form the way forward for international geopolitics.

Two Competing Fashions: China’s authoritarian system emphasizes centralized management and fast state-led growth, whereas India’s democracy fosters a extra decentralized, market-driven strategy. The result of this rivalry can have important implications for the way nations world wide view these contrasting programs, particularly in growing areas which will look to emulate certainly one of these fashions for their very own progress.Geopolitical Rivalry: Each nations are competing for affect, not solely in Asia but in addition globally. India’s rise as an financial energy strengthens its geopolitical place, notably throughout the Quad alliance (comprising the U.S., Japan, Australia, and India) and different international boards. India’s rising financial clout gives an necessary counterbalance to China’s dominance, each inside Asia and on the worldwide stage.

4. Challenges and Dangers for India and China

Each nations face distinctive challenges that would have an effect on their long-term progress trajectories:

India’s Challenges:Infrastructure Deficits: India should deal with important infrastructure gaps in transport, power, and digital connectivity to keep up its progress trajectory.Inequality and Job Creation: Whereas India’s economic system is rising quickly, making certain that progress is inclusive stays a significant problem. The nation should generate hundreds of thousands of jobs to accommodate its massive and youthful inhabitants.China’s Challenges:Demographic Decline: China’s getting older inhabitants presents a long-term problem to its financial dynamism. With a shrinking workforce and rising healthcare prices, China could battle to keep up excessive progress charges within the coming a long time.Debt and Actual Property: China’s financial progress has been pushed by heavy funding in actual property and infrastructure, resulting in excessive ranges of debt. This reliance on debt-fueled progress is now turning into a big drag on the economic system.

Conclusion

The graphs introduced clearly illustrate a defining second in international financial historical past—India has overtaken China when it comes to financial progress and inventory market efficiency, signaling a significant shift in international financial energy. Because the world’s two most populous nations and Asia’s largest economies, the rivalry between these nations extends far past economics. It’s a contest between two opposing fashions of governance—India’s democracy and China’s authoritarianism.

The geopolitical stakes of this rivalry are immense. As India continues to rise, its affect in international financial and political boards will develop, doubtlessly reshaping the stability of energy in Asia and past. In the meantime, China’s financial slowdown and inner challenges may result in a reevaluation of its long-standing dominance. How these two nations navigate their respective challenges will decide not solely their future financial trajectories but in addition the way forward for international governance.

On this contest between two superpowers with opposing ideologies, the world will carefully watch to see which mannequin emerges as the best in fostering sustainable and inclusive progress. The result of this rivalry will reverberate far past the borders of China and India, shaping the way forward for international financial and geopolitical landscapes for many years to come back.

[Photo by Pixabay]

The views and opinions expressed on this article are these of the creator.

Sam Rainsy, Cambodia’s finance minister from 1993 to 1994, is the co-founder and appearing chief of the opposition Cambodia Nationwide Rescue Get together (CNRP).

[ad_2]

Source link