[ad_1]

[Editor’s note: Welcome to the second of our new series on Price Theory problems with Professor Bryan Cutsinger. We reprint this month’s question below; you can also view the original post from earlier this month here. You can also see the solution to last month’s problem here.]

Query:

In response to the Vitality Info Administration, crude oil collectively provides gasoline, heating oil, jet gas, lubricating oils, asphalt, and lots of different merchandise. Suppose the widespread adoption of electrical automobiles (EVs) reduces gasoline demand however doesn’t have an effect on the demand for the opposite merchandise collectively equipped by oil. How will the widespread adoption of EVs have an effect on the worth of those different merchandise?

Reply:

The concept for this query is impressed by Deirdre McCloskey’s terrific value concept textual content, The Utilized Principle of Worth. I like this query as a result of it highlights the interconnectedness of markets and the way highly effective the availability and demand framework may be.

Let’s evaluate two vital concepts earlier than attending to the reply.

The primary thought is that we are able to learn a requirement curve as a schedule exhibiting the utmost amount customers are prepared to purchase at a specific value, or we are able to learn a requirement curve as a schedule indicating the best value customers are prepared to pay for a specific amount, reflecting the marginal values of various portions. For instance, if the worth of oil is $50 per barrel and the amount of oil demanded at this value is 100 barrels, the marginal worth of the a hundredth barrel is $50.

The second thought is that when a very good collectively provides a number of merchandise, as oil does, the demand curve for that good displays the vertical sum of the demand curves for these merchandise. For instance, suppose that oil collectively provides simply gasoline and jet gas in fastened proportions. Let’s say that the marginal worth of the gasoline produced by the a hundredth barrel of oil is $30 and the marginal worth of jet gas produced by that very same barrel is $20. On this case, the utmost value individuals can be prepared to pay for the a hundredth barrel can be $30+$20=$50.

With these two concepts in thoughts, let’s flip to answering the query. To be clear, my reply assumes that each side of the oil market–suppliers and demanders–are value takers, and that the oil provide curve slopes upwards. We might take into account different alternate options to those baseline assumptions, however for our functions, these assumptions will do.

A fall in gasoline demand reduces each the oil value and the amount of oil equipped to the market. Consequently, the availability of the opposite distillates produced by oil should additionally fall since suppliers are producing fewer barrels of oil. Thus, the costs of those distillates should rise to make sure that the portions of those distillates demanded equals the now decrease amount equipped.

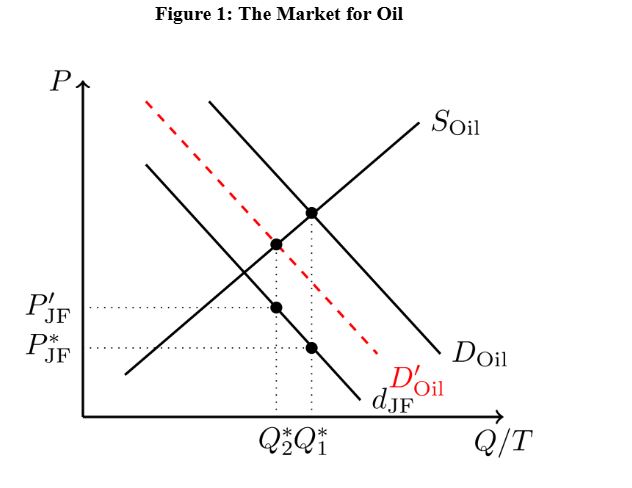

Determine 1 illustrates this state of affairs graphically. For simplicity, the determine solely contains the demand for 2 distillates–particularly, gasoline and jet gas. The demand curve D_Oil displays the whole demand for oil, i.e., it consists of the demand for oil as gasoline plus the demand for oil as jet gas. The demand curve d_JF displays the demand for oil as jet gas. The vertical distance between the demand for oil as jet gas, d_JF, and the whole demand for oil, D_Oil, represents the demand for oil as gasoline.

Initially, there are Q*_1 barrels of oil accessible. At this amount, the worth of oil as jet gas is P*_JF. Decrease gasoline demand reduces the whole demand for oil,, illustrated in Determine 1 by the demand curve D’_Oil. On the new value, suppliers are solely prepared to produce Q*_2 barrels of oil, so the worth of jet gas should rise to P’_JF.

Bryan Cutsinger is an assistant professor of economics within the School of Enterprise at Florida Atlantic College and a Phil Smith Fellow on the Phil Smith Heart for Free Enterprise. He’s additionally a fellow with the Sound Cash Challenge on the American Institute for Financial Analysis, and a member of the editorial board for the journal Public Alternative.

[ad_2]

Source link