[ad_1]

A UPS seasonal employee delivers packages on Cyber Monday in New York on Nov. 27, 2023.

Stephanie Keith | Bloomberg | Getty Photographs

November’s stable jobs report didn’t guarantee that the financial system will are available for a gentle touchdown, however it did assist to clear the runway somewhat extra.

In any case, there’s nothing a couple of 3.7% unemployment charge and one other 199,000 jobs that even whispers “recession,” not to mention screams it.

No less than for now, then, the U.S. financial system can take one other win with a small “W” because it seems to be to navigate by means of what had been the best inflation degree in additional than 40 years — and a still-uncertain path forward.

“Total, the roles market is doing its half to get us to a gentle touchdown,” mentioned Daniel Zhao, lead economist at jobs score website Glassdoor. “It is boring in all the suitable methods. That is a welcome change after just a few years of less-boring experiences.”

Certainly, regardless of a excessive degree of hysteria heading into the Labor Division’s nonfarm payrolls report, the main points have been pretty benign.

The extent of job creation was simply above the Wall Avenue estimate of 190,000. Common hourly earnings rose 4% from a 12 months in the past, precisely consistent with expectations. The unemployment charge unexpectedly declined to three.7%, easing worries that it may set off a traditionally dead-on sign referred to as the Sahm Rule, which coordinates will increase of the unemployment charge by half a share level to recessions.

Nonetheless, the stable report could not dispense the lingering feeling that the financial system is not out of the woods but. The concern primarily comes from worries that the Federal Reserve’s aggressive rate of interest will increase have not exacted their full toll and nonetheless may set off a painful downturn.

“The important thing uncertainty for the labor market in 2024 is whether or not job progress slows to a extra sustainable tempo, or whether or not the financial system strikes from month-to-month job good points to month-to-month job losses. The previous could be in line with the Fed’s soft-landing state of affairs, whereas the latter would imply recession,” mentioned Gus Faucher, chief economist at PNC Monetary Companies. “PNC nonetheless thinks recession is the extra possible end result in 2024, however it’s a shut name.”

All about customers and inflation

Key as to if the so-called touchdown is gentle or exhausting would be the shopper, who collectively accounts for practically 70% of all U.S. financial exercise.

On that entrance, there was one other spherical of fine information Friday: The College of Michigan’s intently watched shopper sentiment survey confirmed that inflation expectations, a key financial variable for costs, plummeted in December. Respondents put one-year inflation expectations at 3.1%, a shocking 1.4 share level drop.

Nevertheless, such gauges may be “fluky” and will not be consistent with another alerts coming from customers, mentioned Liz Ann Sonders, chief funding strategist at Charles Schwab. Debates over gentle landings and inflation expectations and rate of interest outlooks are inclined to miss larger factors, Sonders added.

Previous to 2023, Sanders and Schwab had been stressing the notion of “rolling recessions,” that means that contractions may hit sure sectors individually whereas not dragging down the financial system as an entire. The excellence should still apply heading into 2024.

“The recession versus gentle touchdown debate type of misses the required nuances of this distinctive cycle,” Sonders mentioned. “A best-case state of affairs is just not a lot a gentle touchdown, as a result of that ship has already sailed for [some] segments. It is that we proceed to roll by means of such that if and when providers will get hit greater than the temporary ding up to now and it takes the labor market with it, you are already in stabilization or restoration mode in areas that already took their huge hits.”

Attending to the gentle touchdown, then, possible would require navigating a few of these peaks and valleys, none extra so than establishing confidence that inflation actually has been vanquished and the Fed can take its foot off the brake. Inflation, based on the Fed’s most popular gauge, is operating at 3.5% yearly, effectively above the central financial institution’s 2% purpose, although is persistently falling.

Nonetheless nervous about charges

There was one different good piece of inflation information Friday: Rental prices nationally declined 0.57% in November and have been down 2.1% 12 months over 12 months, the latter being the largest slide in additional than 3½ years, based on Hire.com.

Nevertheless, one fascinating improvement from the most recent financial knowledge was a bit much less market confidence that the Fed can be slicing rates of interest fairly as aggressively as merchants beforehand believed.

Whereas the merchants within the fed funds futures house nonetheless roundly anticipate that the Fed is finished mountain climbing, it now expects solely a couple of 45% likelihood of a beforehand anticipated reduce in March, based on CME Group knowledge. Merchants beforehand had been anticipating 1.25 share factors price of cuts in 2024 however lowered that outlook as effectively to a toss-up with only a full level of decreases following the information releases.

Which will in itself seem to be solely a nuanced change, however the transfer in pricing displays uncertainty over whether or not the Fed retains speaking robust on inflation, or concedes that coverage not must be as tight. The fed funds charge is focused in a variety between 5.25% and 5.5%, its highest degree in additional than 22 years.

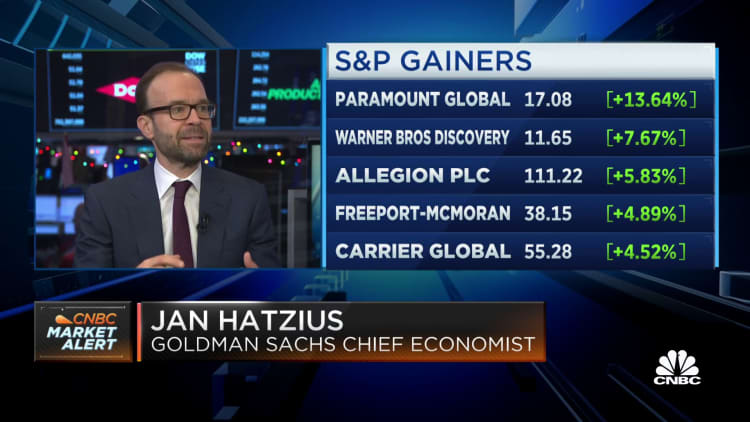

“The important thing factor although, from a broader perspective, is that they will reduce if the financial system have been to see extra of a slowdown than we anticipate. Then the Fed may reduce, may present some help,” Jan Hatzius, chief economist at Goldman Sachs, mentioned Friday on CNBC’s “Squawk on the Avenue.” “Which means the danger of recession is in my opinion fairly low.”

Goldman Sachs thinks there’s a couple of 15% likelihood of a recession subsequent 12 months.

If that forecast, which is about the usual likelihood given regular financial circumstances, holds up, it’ll require continued power within the labor market and for customers.

Intervals of labor unrest this 12 months point out, although, that not all could also be effectively on Fundamental Avenue.

“If issues have been going nice, then individuals wouldn’t be marching within the chilly and rain as a result of they need extra pay as a result of the price of residing goes up,” mentioned Giacomo Santangelo, an economist at job search website Monster.

Employees will not want economists to inform them when the financial system has landed, he added.

“The alleged definition of a gentle touchdown is to convey inflation right down to 2% to 2½% and have unemployment go as much as that full employment degree. That is actually what we’re in search of, and we’re not there but,” Santangelo mentioned. “Once you’re on an airplane, you realize what it looks like when a aircraft lands. You do not want the individual within the cockpit to return on and go, ‘Alright, we’ll be touchdown now.”

Do not miss these tales from CNBC PRO:

[ad_2]

Source link

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/archetype/3WI3OMMF5BFYNFSVY3PX5XMABE.jpg)