[ad_1]

Mom Jones; Nati Harnik/AP, Evan Agostini/Invision/AP; Getty

Because the creator of a e-book about runaway wealth in America, I’ve thought a good bit concerning the Giving Pledge, the unique do-gooder membership Invoice and Melinda French Gates launched in 2010 with their pal Warren Buffett and 37 different billionaires, all vowing to offer away nearly all of their fortunes.

Now that the pledge has been round greater than a decade, one can fairly ask what progress its members have made towards their aim. As we’ll quickly see, most of them have made little or no.

In some respects, the entire enterprise appears like a little bit of a rip-off. Not within the authorized sense—although no less than one former pledger was not too long ago convicted of monetary fraud and a present member took a federal plea deal to flee prosecution for a similar.

I imply a rip-off within the sense of a self-selected group of excessively rich folks—a few of whom have made their fortunes in problematic methods and sure most of whom have used excessive methods to keep away from taxation—burnishing their reputations at the same time as they train undemocratic affect over issues of public curiosity.

Solely about 1 in 13 billionaires have taken the pledge, and most will stay billionaires after freely giving a “majority” of their wealth.

And perhaps they persist with the pledge and perhaps they don’t—or perhaps they persist with it by bankrolling very, very dangerous causes. As a result of the Giving Pledge asks neither the place its members’ cash got here from nor the place it’s going.

The pledge, its organizers concede, is “an ethical dedication…not a authorized contract,” so signatories will not be held to their promise. Solely about 1 in 13 of the world’s billionaires are “members,” and most will stay billionaires after freely giving the “majority” of their wealth, which is half plus a penny.

Up to now, 241 terribly wealthy people and {couples} from 29 nations have signed up—or 243 when you embody the rejects. These embody the above-referenced crypto bro, Sam Bankman-Fried, whose internet value plummeted from a peak of $26.5 billion to about $4 million, and T. Denny Sanford, an early pledger who made his fortune peddling high-interest bank cards to hard-up debtors.

Sanford had given generously to children’ packages, however was quietly eliminated as a Giving Pledge member final 12 months, after ProPublica reported that investigators had discovered nude photographs of youngsters in certainly one of his e-mail accounts. (No prices had been filed.)

One large inspiration for the pledge was the late billionaire Chuck Feeney, who’s revered by Buffett and Gates, and is the one pledger I do know of who has given away not only a majority of his fortune however practically all of it. (Solely MacKenzie Scott seems on monitor to duplicate that feat.) In his bestselling biography, The Billionaire Who Wasn’t, creator Conor O’Clery writes that Feeney agreed to hitch the pledge reluctantly. He wasn’t an consideration seeker, and after a quarter-century of stealthy giving, he was now not a billionaire both.

Elon Musk signed the Giving Pledge in 2012. His inflation-adjusted wealth has since elevated by greater than 9,000 %.

The pledge was additionally, like the remainder of America’s philanthropy-industrial advanced, impressed partially by Andrew Carnegie, the Gilded Age metal baron who argued in his extensively learn 1889 essay, The Gospel of Wealth, that captains of trade comparable to he should dispense with their extreme fortunes for public profit inside their lifetimes, or else die “disgraced.”

The Giving Pledge is simply Carnegie-lite, nonetheless, as a result of its members are allowed to satisfy their promise—or not—in both life or demise, and dangle onto half of their hoards. Carnegie, who adopted his personal counsel by constructing universities and analysis establishments and hundreds of libraries in the US and overseas, would little doubt take into account the pledge weak tea.

In any case, given the speed at which billionaires’ fortunes broaden—which has a lot to do with the best way our authorities taxes investments and provides retirement subsidies and tax-avoidance alternatives to individuals who can afford $1,000-an-hour attorneys—their property pile up quicker than they’ll realistically dispense with them.

So how are the pledgers faring? Let’s have a look.

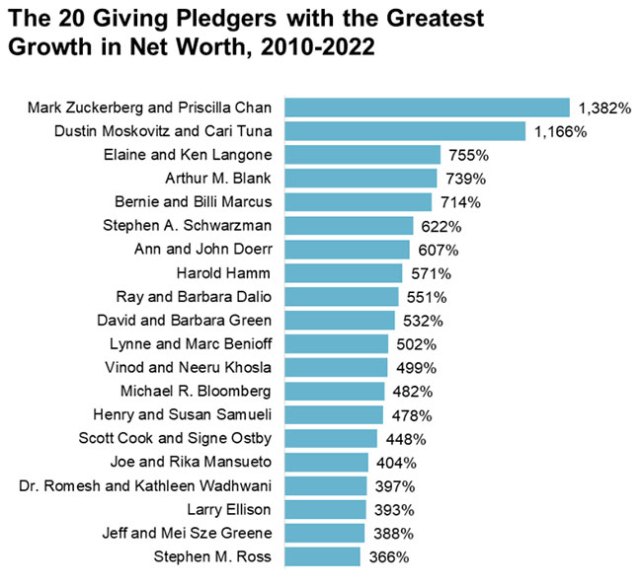

Within the newest report on billionaire philanthropy from the nonprofit Institute for Coverage Research, authors Helen Flannery, Chuck Collins, and Bella DeVaan use Forbes knowledge to calculate that the 73 surviving American pledgers who had been billionaires when the pledge was created in 2010 have greater than doubled their collective wealth since then—and 30 people have seen their internet worths no less than triple. Behold the best hits. (Arduous to imagine, however Musk wasn’t a billionaire in 2010.)

I used Forbes knowledge (a few of which IPS supplied) to ask a barely completely different query, particularly: How wealthy are the longest-standing (decade-plus) American pledgers right now vs. the 12 months they signed up?

Based mostly on my calculations, no less than 60 % of these 75 pledgers are value as a lot or extra now, after adjusting for inflation, as they had been again then. One-third have seen their wealth double or extra. Eighteen noticed it triple, 9 noticed it quadruple, and (aptly) 5 noticed their wealth no less than quintuple. The three greatest winners had been Quicken Loans co-founder Daniel Gilbert and his spouse, Jennifer (+10.5x), Mark Zuckerberg and Priscilla Chan (+21.1x), and good previous Elon (+91.2x).

And what of Invoice Gates, whose title has turn out to be synonymous with philanthropy (amongst different issues)? In 2014, Gates revealed a evaluate of Capital within the twenty first Century, French economist Thomas Piketty’s bestselling e-book about inequality. Gates wrote: “I absolutely agree that we don’t need to dwell in an aristocratic society by which already-wealthy households get richer just by sitting on their laurels and accumulating what Piketty calls ‘rentier earnings’—that’s, the returns folks earn after they let others use their cash, land, or different property. However I don’t suppose America is something near that.”

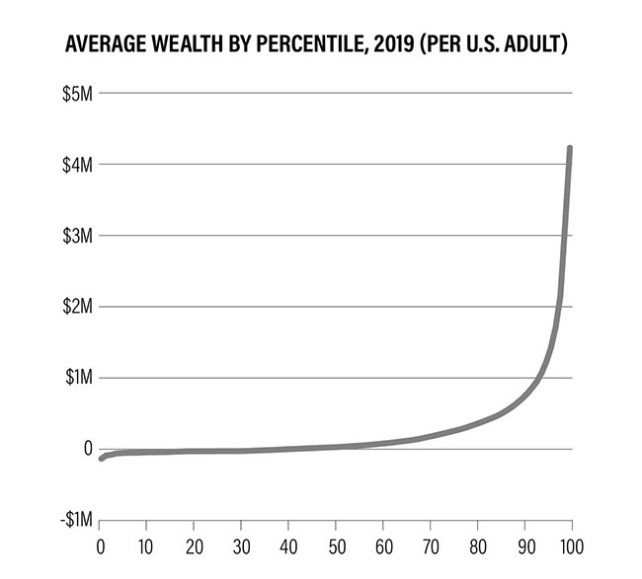

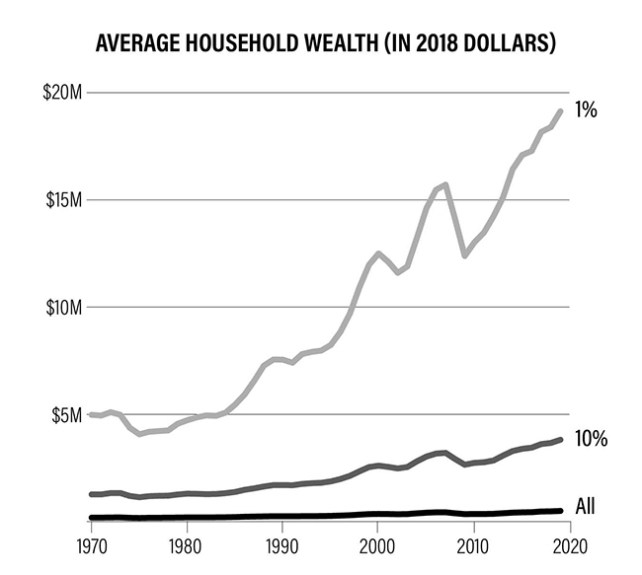

Gates, whose fortune on the time was $76 billion (about 99 billion in right now’s {dollars}), will need to have been affected by rich-man delusions. As a result of America was already absolutely immersed within the situation he described, due to many years of tax cuts for the wealthy that resulted in a top-heavy wealth distribution unseen for the reason that Gilded Age. Listed below are two charts from my e-book. (The strains within the backside chart symbolize households from the richest 1 %, richest 10 %, and the US inhabitants as a complete.)

It’s true that Gates has put extraordinary sums into his charitable pursuits. From 2010–2022, per IRS paperwork, some $66.1 billion has flowed from his accounts and trusts into the Invoice and Melinda Gates Basis. So let’s interrogate {that a} bit.

First, the couple has acquired extraordinary tax breaks for these contributions, and the muse’s tax-exempt actions are closely backed. The Gateses’ largesse, in the meantime, hasn’t even made a dent in “the corpus,” the hive of household property whence all of the honey flows—and there’s numerous honey flowing. Throughout that very same time interval, the mixed internet worths of Invoice Gates and Melinda French, who divorced in 2021, soared by greater than $82 billion—from $53 billion in 2010 to $135.2 billion in 2022, per Forbes knowledge.

As of November 27, Forbes had Invoice’s wealth pegged at $117.2 billion and Melinda’s at $10.2 billion. Which suggests, even with all their giving, their collective, inflation-adjusted wealth is now 171 % of what it was after they launched the pledge.

The charitable tax deduction alone prices the US authorities $56 billion per 12 months, and states sacrifice tens of billions extra in misplaced income.

The IPS notes that solely “a tiny handful” of the pledgers it scrutinized had both given away half their property or publicly introduced that they’d organized to take action of their property plans. What’s extra, most of their donations haven’t gone on to charities—as MacKenzie Scott’s have—however to their very own foundations and donor-advised funds (DAFs).

That makes an enormous distinction. Non-public foundations and DAFs—a fast-growing various automobile—have turn out to be repositories for a really large trove of publicly backed however unspent philanthropic property. On the finish of 2019, the IRS estimates, there have been greater than 103,000 personal foundations with property totaling greater than $1.1 trillion—nearly three quarters of which was managed by foundations value $50 million or extra. On the finish of final 12 months, DAFs held $229 billion in property, greater than double the 2017 complete.

Neither foundations nor DAFs obtain a lot oversight, regardless of the epic tax breaks their creators take pleasure in. In 2021, for instance, Musk gifted his basis $5.7 billion, principally Tesla inventory, a donation that, in accordance with one Bloomberg op-ed author, could have saved him as much as $4.6 billion in state and federal taxes.

Such numbers add up. The tax deduction for charitable donations—which fits primarily to the wealthiest 10 % of taxpayers—prices the federal authorities $56 billion per 12 months in income, and state and native governments sacrifice tens of billions extra. Throw in different sorts of tax breaks, the IPS authors say, and we’re speaking a whole bunch of billions of {dollars} a 12 months in subsidies.

In trade for his or her (largely) tax-exempt standing, personal foundations are required to spend no less than 5 % of their property annually on charitable pursuits—which incorporates overhead. Most hew near this naked minimal. Over the previous 5 years, the IPS calculates, median payout charges for foundations value $1 billion or extra have ranged from 4.6 and 5.4 %.

Worse but, these minimal payouts embody compensation foundations present to their creators’ members of the family who function staff or trustees—the du Pont chemical dynasty’s Longwood Basis pays its president (and founder’s namesake), Éleuthère Irénée du Pont II, greater than $350,000 a 12 months. Additionally deductible, bizarrely, are grants a basis makes to its creator’s personal donor-advised funds.

From 2015 via 2020, greater than 80 % of the Musk Basis’s roughly $98 million in “charitable items” went to donor-advised funds.

From 2016 via 2020, for instance, greater than 80 % of the Musk Basis’s roughly $98 million in “charitable items” went to Vanguard Charitable or Constancy Charitable, which host particular person DAFs, presumably together with Musk’s. It’s an “unlucky loophole,” Harvey Dale, who served 20 years as president and CEO of Chuck Feeney’s now-shuttered Atlantic Basis, informed me in an e-mail.

The paltry payouts, in any case, are greater than matched by incoming revenues (dividends, rents, and many others) and the swelling worth of foundations’ untaxed funding property. As I identified in Jackpot, personal foundations total expended roughly 6 % of their property in 2019—a 12 months by which the S&P 500 clocked a 29 % acquire. The next 12 months, amid the pandemic, a coalition of rich progressives launched a marketing campaign imploring Congress to impose a ten % payout minimal on foundations and DAFs alike. Response: crickets.

The glacial tempo of basis giving would appear to violate the spirit of the Giving Pledge. Take into account the late Intel founder Gordon Moore and his spouse, Betty, each now deceased. Based on IPS, they established their basis in 2000 with a $5 billion reward, nearly two-thirds of their internet value on the time, however made no additional contributions. Twenty years later, on the finish of 2021, their basis reported internet property in extra of $9.5 billion. Its giving “has mirrored the deliberate tempo of [the Moores’] private giving,” the authors write, “typically treating the 5 % minimal payout requirement as a ceiling, reasonably than a flooring.”

Donor-advised funds, even much less regulated, haven’t any obligatory payout. In addition they have a transparency downside—or profit, relying on the place you sit. Whereas foundations should reveal their beneficiaries to the general public, DAFs haven’t any such requirement. So in case your charity consists of bankrolling dark-money nonprofits just like the Federalist Society or “instructional” nonprofits that unfold disinformation about local weather science, no one would be the wiser. Which is undoubtedly one purpose they’ve grown so common.

The IPS lauds a handful of pledgers, together with Scott, Salesforce’s Marc Benioff, and Ted Turner, and takes purpose at others, like Oracle’s Larry Ellison, who has mentioned he’d give away “no less than 95 %” of his (as of Monday) practically $150 billion fortune however thus far has doled out however a tiny fraction, and has a spotty basis monitor document in addition. There’s additionally billionaire Patrón Spirits co-founder John Paul DeJoria, whose Peace, Love, and Happiness Basis, IPS estimates, has given out simply $26 million since its inception in 2011.

Aviation security mogul Albert Lee Ueltschi signed the pledge in 2012, only a month earlier than he died, in accordance with IPS, however he moved about half of his $4 billion right into a belief for his inheritors and ended up giving solely $460 million to charity.

Chase Manhattan CEO David Rockefeller additionally fell wanting giving a majority. He’d mentioned he deliberate to offer the majority of his wealth to charity at demise, the IPS notes, however when he died in 2017, most of his remaining $3.3 billion in property “had been held in trusts for his youngsters and solely about $700 million was left to offer out to charity. All informed, Rockefeller gave away an estimated $1.7 billion over the course of his lifetime and in his will,” the report says.

Texas oil billionaire George P. Mitchell will need to have harbored some guilt, as a result of he contributed hundreds of thousands to environmental teams. However IPS estimates that Mitchell gave away solely $596 million in life and demise—about one-fifth of his closing internet value.

Nope. Andrew Carnegie wouldn’t like this one bit.

[ad_2]

Source link